Contents:

Momentum indicators can be a useful tool when providing overbought and oversold signals. Forex traders can use it to identify the strength of the market movement, and whether the price is moving up or down. Resistance and support levels are dynamic and are prone to price breakouts in either direction. If the price exceeds important support or resistant levels it is likely to breakout.

First, you must identify a trend as you would when trend trading—make sure that the price highs are growing and that price lows are moving up as well. Then, you should buy the dip, hold as the upward movement has momentum, and sell as soon as prices reach the resistance line. The product type you choose to trade will determine how risky this strategy is, but you’ll usually be dealing with small price changes, so your balance won’t suffer much if you make a bad trade. This makes leveraging your trades more viable as the risk-reward ratio is manageable. If you have fire in your heart and want to make money for forex, that’s the most important thing. However, it’s also crucial to have a good strategy because not having one is like throwing your money into a well and waiting for those profits to start rolling in (they won’t).

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

You should then set up the ATR indicator against the daily price chart and apply it. In one, set the time period to 50 days, in the other, set the time period to 200 days. It has been well established by academic research that the price movement of liquid financial instruments shows a momentum effect. This means that when prices are moving strongly in one direction, it is more likely that this directional movement will continue over the short-term than reverse. Also, it is likely that any further movement in the direction of the trend will be stronger than any movement against the trend. Depending upon the type of trader you want to be, you may find it useful to begin following the major news events and economic data releases which tend to affect the markets you will be trading.

How can I learn and backtest a forex trading strategy?

Central Banks Make the Rules – As the highest financial authorities in their countries, central banks can inflate and deflate currencies quickly through their decisions. For example, if you’re dealing with USD a lot, make sure you follow what the FED and the government are doing. As soon as a major decision is announced, traders start acting like it’s already been realized and prices change.

This is a good fit for beginners or those who are experienced and what to try out a new strategy. Just because you choose a strategy to trade forex with at the start, this does not mean you have to stick with this strategy forever. You should monitor your performance, and make a personal decision when it’s time to change strategies. It might sound obvious, but the first rule in Forex trading, or any other kind of trading for that matter, is to only risk the money you can afford to lose. Many traders, especially beginners, skip this rule because they assume that it “won’t happen to them”.

In such a volatile, fast-moving market, the stakes are amplified. Succeeding as a day scalper demands unwavering concentration, steady nerves, and impeccable timing. If a trader hesitates to buy or sell, they can miss their profit window and dwindle their resources. News traders rely on economic calendars and indexes such as the consumer confidence index to anticipate when a change will occur and in what direction price will move.

Best Currency Pairs To Trade?

If you want a fresh and best strategy for trading forex strategy with a clear daily financial goal—then the 50 pips a day forex strategy is it. GMT, after the candlestick closes, traders enter two opposite positions with pending orders. When one order gets triggered by a price movement, the other one gets canceled automatically.

Don’t just give up after one session, because the markets can be volatile and you may have a slight learning curve. However, it may be wise to set a limit for yourself about how much you want to lose before trying something else. This strategy is a good way to approach the forex market for those who need to be quick with limited time. This is an intraday strategy that has largely grown in popularity, and is quite versatile with all the different ways you can analyze a currency pair during a given one-hour timeframe.

Make sure you sign up for my free Forex and Cryptocurrency charts I publish every weekend

When the bands widen, this is an indication that the market has become more volatile. A Bollinger Band will have an upper and lower threshold above and below the SMA line. The SMA line is sometimes referred to as the ‘middle’ Bollinger Band. Position trading can leverage market trends, recurrent styles, and past movements in order to predict and make trading moves. Hence, position traders are often referred to as ‘trend followers’. You play this risk management game right and you can be making a tonne of money trading forex.

Knowing when to https://g-markets.net/ is a fundamental part of being a trader, and often one of the most difficult aspects to learn. Be sure to control your emotions, or more often than not your unrealised gains will soon turn into realised losses. Check the Sentiment – Checking the sentiment could potentially show you if you are trading in the right direction.

For some, because the forex currency market operates 24hrs during the day, they can trade after work for a few minutes or hours each day. Therefore, if you are looking forForex trading strategies that work, just understand that one system cannot work for all. And yes, it’s not going to cost you anything…it is absolutely free. Simple here means that the trading rules of these Forex trading strategies are really easy to understand and execute when you are trading. You can wipe your trading account within a few seconds to minutes because price can move against you so fast you will be caught out. The next group of Forex trading strategies on this Forex website areForex scalping strategies.

But fortunately, there are various methods used to establish and develop a forex strategy, each with high potential rewards and risks ingrained in the strategy. Here, we will cover four of the most common forex trading strategies that work and show you how you can start using them. Paying attention to daily pivot points is especially important if you’re a day trader, but it’s also important even if you’re more of a position trader, swing trader, or only trade long-term time frames. Because of the simple fact that thousands of other traders watch pivot levels.

Breakout Trading Strategy

Retracements should not be confused with reversals – while reversals indicate a major change of the trend, retracements are just temporary pullbacks. By trading retracements, you are still trading in the direction of the trend. You are trying to capitalise on short-term price reversals within a major price trend. First of all, you need to determine which event you want to trade and which currency pair it will affect the most. A meeting of the European Central Bank will certaintly impact the Euro the most. If you are expecting a hawkish ECB that will signal rate hikes, it would make sense to pick a low-yielding currency, such as the Japanese Yen.

Traders should pay close attention to central bank announcements and policy statements for clues about future currency movements. Fortunately, there are a few different things that you can do in order to protect your capital. For starters, it’s always a good idea to start off with a small account. This way, even if you do lose money, it won’t be as much as if you had started with a larger account. FXOpen is a global forex and CFD broker, with a network of worldwide brokerages regulated by the FCA, CySEC and ASIC. A price should touch the upper line if it’s a bullish trend and the lower line if it’s a bearish trend.

Above is an example of a buy setup using the 1-hour forex trading strategy with Bollinger Bands, combined with price action. You can see just before the hammer there is a huge sell-off, then the hammer indicates that the bears have now lost control and the bulls are taking over. What gives strength to this indication is the fact that it has broken past the Bollinger Bands – which could indicate that this asset is currently oversold.

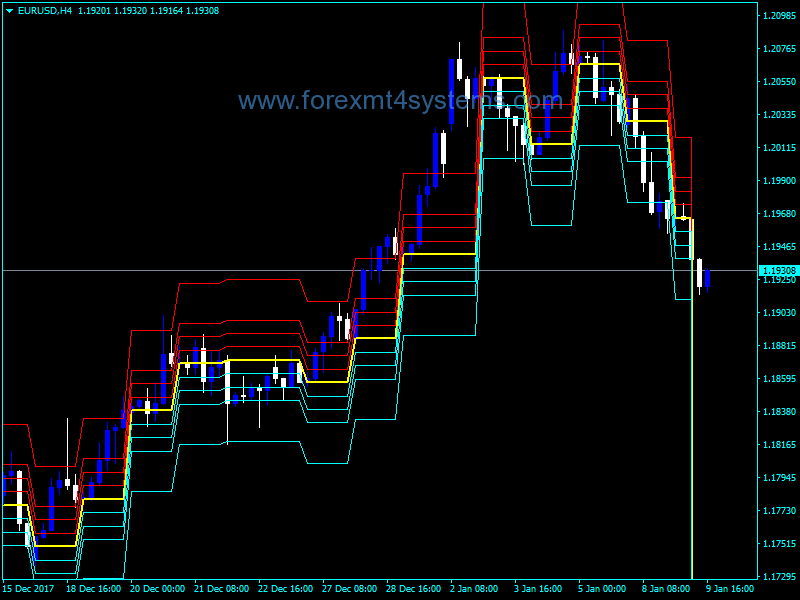

“Profit Parabolic” trading strategy based on a Moving Average

Before placing buy and sell stop orders, traders will first identify support and resistance levels and use this bracketed range as a guide for setting up orders at standard intervals. Support and resistance levels can be calculated using technical analysis or estimated by drawing trend lines onto a price graph to connect price peaks and valleys . Because grid trading doesn’t require insight into the direction of the breakout, orders can be placed ahead of time. Typically, grid traders will lay out their strategy after the market has closed and preemptively create orders for the following day. Position Trading – Position trading is a strategy where traders hold positions for longer periods of time, usually weeks or months. Position traders will generally utilize fundamental analysis and economic data.

What Are Crypto Price Gaps and How Can You Spot Them? – MUO – MakeUseOf

What Are Crypto Price Gaps and How Can You Spot Them?.

Posted: Thu, 30 Mar 2023 12:31:00 GMT [source]

We will consider a currency trading strategy with the stochastic oscillator you can practice on the FXOpen TickTrader platform. Each Forex trading technique is specific and requires certain skills. They differ mainly by the time horizon, that is, the amount of time a trader wants to hold an open position.

A trader would go buy a currency with a high interest rate and sell a currency with low interest rate. A popular example is going long AUD/JPY (due to Australia´s historically high and Japan´s historically low interest rates). By doing so, the trader will receive an interest rate payment based on the size of their position.

Is a methodology a trader relies on to know when to place a buy or sell order on any tradable instrument. A good strategy contains both entry and exit parameters, thus removing the guesswork from the trading experience. Another highly-effective Forex trading strategy for beginners is the inside bar strategy. Unlike the pin bar, the inside bar is best traded as a continuation pattern. This means we want to use a pending order to trade a breakout in the direction of the major trend. Breakout trading involves taking a position as early as possible within a given trend.